Corporate Rating Services - Overview

Our Rating Philosophy

CRA rates entities and financial instruments following the proprietary rating methodology. The methodology incorporates the latest frontier knowledge in corporate finance, strategic management and management philosophies and it presents our standardized approach to the rating process used within CRA and therefore limits subjectivity and improves the objectivity of the rating outcomes. It explains our approach to the assessment of credit risk and is intended to be a reference tool for evaluating the credit profiles of companies thereby helping our credit risk analysts, concerned entities, investors and other interested market participants understand how the key qualitative and quantitative risk characteristics are likely to affect rating outcomes.

Another key objective of the methodology is to be an accurate and stable measure of relative credit risk which will be correlated with subsequent default and loss. We aim to ensure that our ratings represent independent opinions on the future ability of the borrowers to make payments on their financial obligations on time and in the manner agreed. These ratings are through the cycle forward looking opinions or assessments of a firms' ability to repay debt.

Since credit profiles of companies are not identical each (broad) ratings category is further differentiated by notching up or down represented by the signs ( +) or (-) respectively to ensure that credit risk ratings assignments are as accurate as possible and reflect the fundamental differences in the credit profiles of companies between high, medium and low risk within each rating category.

Types of Credit Ratings Services

CRA professionally undertakes the following types of credit ratings:

1. Institutional Ratings:

This type of rating encompasses the entire institution and its ability to service debts it contracts. It is essentially a rating of the institutional viability. This rating is useful to not only potential lenders to the institution but also providers of equity and other stakeholders.

2. Debt Instrument Ratings:

This type of rating focuses on a particular debt instrument issued by an institution. These would include long term instruments such as corporate bonds and short term instruments such as commercial paper. The debt instrument would be assessed in light of the institution’s projected cashflows and its specific ability to service the contracted debt.

3. Bank Loan Ratings:

These ratings are specific to banks and other financial institutions that advance credit. Bank Loan Ratings are used by banks to determine risk weights for their loan exposures, in line with the Bank of Zambia’s guidelines for Implementation of the New Capital Adequacy Framework under Basel II framework. CRA rates all type of fund-based and non-fund based facilities sanctioned by Banks. This would include cash credit, working capital demand loans, Letter of Credit, Bank guarantees, Bill discounting, Project loans, Loans for general corporate purposes etc.

Ratings Advisory Services: In addition to the above specific ratings, CRA provides rating advisory services. We are aware that many of our clients contemplating the first credit rating would in the first place like to have initial non-rating assessment. For such clients, we assess the likely outcome of the rating process by conducting confidential and non-public credit ratings. The clients use such a report for internal consumption. The report contains recommendations on how the clients can improve future rating outcomes. This report documents details about all the major weaknesses that significantly impact the rating outcomes and the major measures that the client is required to take to prepare for the actual credit rating. For clients about to undergo a credit rating or other financial assessments with another rating agency, CRA supports such clients throughout all stages of the process. CRA assists its clients by directly engaging with the rating agencies, preparing the clients for rating agency interviews and ensure that all supporting information and analysis of that information is presented to agencies in the best possible light.

Rating Process

In order to perform a rating we first identify the key quantitative and qualitative rating factors which are generally most important in assigning credit ratings in the particular industry and consequently seen as critical in the determination of a company’s credit worthiness or credit risk profile. Each key rating factor also encompasses sub-rating factor each of which drives the rating of the related key rating factor. We analyse the issuer’s organisational effectiveness, financial standing and operational performance using renowned management techniques such as SWOT Analysis, PEST Analysis and competitive rivalry using Michael Porter’s 5 Forces Model.

Our methodology also recognizes that differentiating factors affects the credit profile of companies differently and that some rating factors may have a stronger bearing on the outcome of the rating process than other rating factors. In recognition of this possibility we always attempted to assign weights to rating factors to closely mirror circumstance existing at the time of the rating process.

We also recognize that the factors and related weights are indicative only and in some instances it may be necessary to assess whether they can still hold, at the time of the rating exercise, in the light the peculiarities as well as recent developments around the factors, the entity being rated or the industry in which that entity operates.

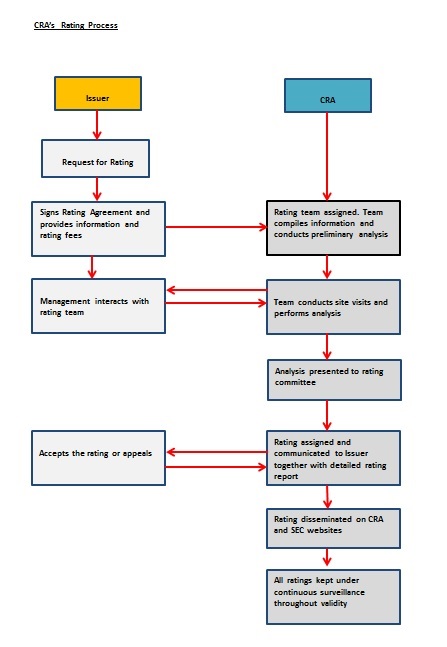

The rating process followed by CRA is presented diagramatically below:

Ratings and the Rating Scale

The ratings available under our rating framework together with a detailed explanation of what each rating means is provided by in Table 1 below. Ratings falling in the rating category of AAA to BBB represent investment grade i.e. of acceptable level of risk whilst ratings below BBB represent investments of a riskier or speculative type. The ratings are a result of both quantitative and qualitative risk assessments and review of the Rating Advisory Committee recommendations to the Board Rating Committee. The final ratings are announced by the Board Rating Committee.

The rating methodology applies a very narrowly defined overall rating range to 1 decimal points for aggregate weighted total factor score (i.e. the sum of the product of sub-factor numerical scores and the sub-factor weights) to recognize that credit risk profiles of entities are not identical and to reflect the unique characteristics of each entity or debt issue. This means that two entities or debt instruments may be rated in the same broad credit risk category of say BBB category, but there are likely to be peculiar circumstances that differentiate one entity or debt instrument from the other hence assigning an identical credit risk rating becomes inappropriate hence the need to notch up or down the initial rating.

Table 1: Credit Ratings and Interpretation

Nomenclature |

Long-term Rating |

Short-term Rating |

AAA |

Highest quality, minimal credit risk |

Prime |

AA+ |

High quality, very low credit risk |

Prime |

A+ |

Upper-medium, low credit risk |

Prime/Subprime |

BBB+ |

Medium grade, moderate credit risk |

Subprime |

BB+ |

Substantial credit risk |

Not prime/speculative |

B+ |

High Credit Risk |

Not investment grade, Not prime/very speculative |

C+ |

Very High Credit Risk |

Not investment grade, very high risk/extremely speculative |

C |

In default or near default, some recovery prospect |

Not investment grade, Loss/extremely speculative |

C- |

|

|

What this means for businesses

Your Board and Management have worked extremely hard to get your business to its current level. You still see the potential for further growth, but are trapped by lack of financial resources needed to leap forward. Without financial resources this potential remains a dream. You may be considering listing on LuSE’s main exchange or on the newly introduced Alternative Investment Market in order to tap into the local capital market or access foreign capital. You wonder how to escape the financial trap?

CRA is here to help you access capital locally and internationally. So simply get a Rating from CRA and see how the world of funding opportunities unfolds to enable you attract funds at competitive interest rates.

CRA is the pioneer credit rating service provider in Zambia, dully authorised to practice by the Securities and Exchange Commission. CRA provides credit rating services for corporate entities, municipalities, other businesses; debt instruments (such as bonds, securities and commercial papers) and projects.

Stakeholders in credit ratings

Credit ratings help a diverse group of stakeholders and can play a useful role in helping investors and others (stakeholders) sift through information and analyze the credit risk they face.

- Lenders use the ratings as indications of the credit worthiness of current or intending borrowers and the ratings help lenders to differentiate rates of interest charged or amounts of the required collateral among different borrowers.

- Bond issuers and other Borrowers with a higher credit rating benefit by being charged lower interests rates than those charged to borrowers with lower or no credit ratings. Further, borrowers enjoying relatively high credit rating would not be subject to loan covenants thus allowing greater flexibility in their operations and future funding needs.

- Government and Government Departments will find credit ratings very useful in their assessment of the capacity of contractors to perform, meaning that projects would not be awarded to contractors with a high credit risk profile without taking adequate mitigation of the risk.

- Investors in bonds and other financial instruments also find ratings useful when deciding on investment opportunities and look at ratings as standardized and structured ways of pricing of the credit risk they face when purchasing the bonds or other instruments of issuers.

- Regulatory authorities including the Bank of Zambia, the Securities and Exchange Commission, the Pensions and Insurance Authority, Energy Regulation Board, ZICTA etc can also use ratings as independent views or opinions on the standing of entities under their respective supervision.

- Customers of commercial banks will find CRA ratings very useful in discriminating between banks for their hard earned savings.

- Entities can target to maintain a certain level of credit risk profile and use our ratings standard measures.

info@creditratingagency.net